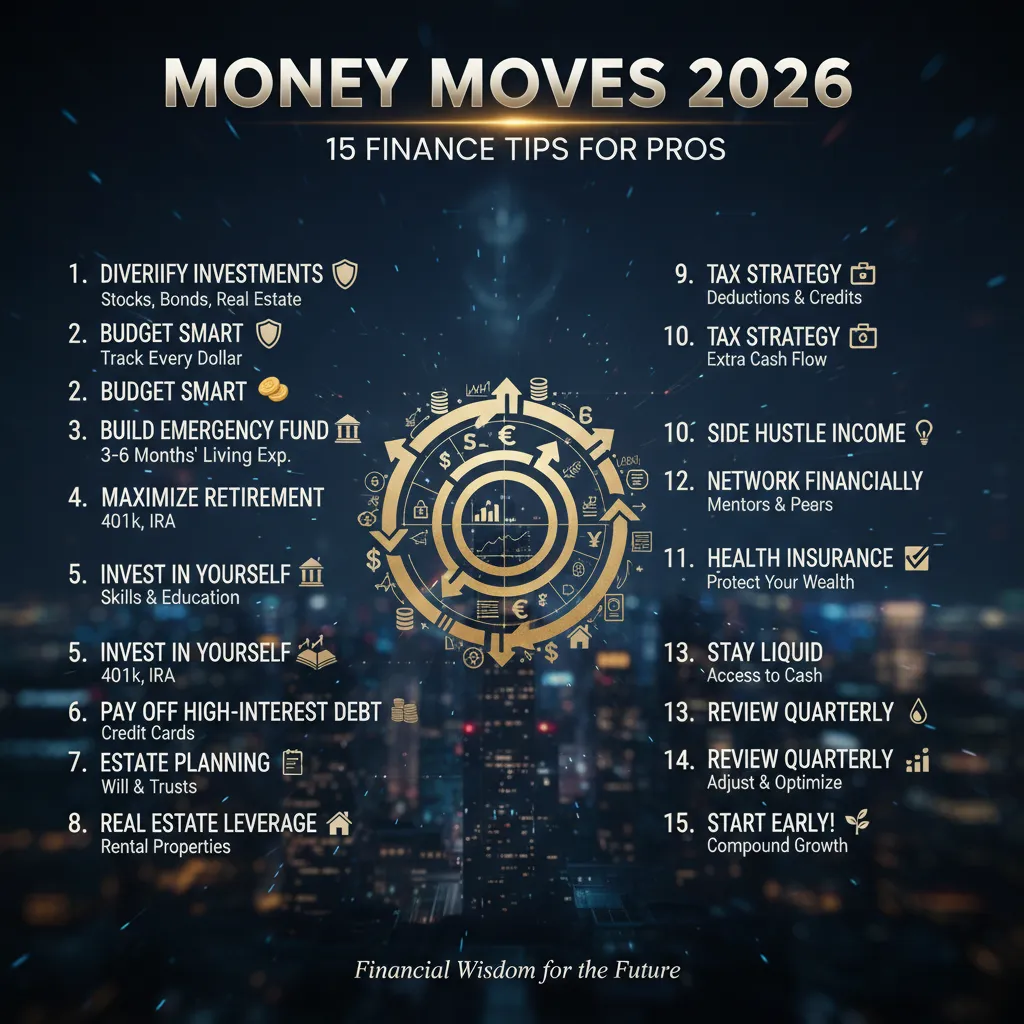

Money Moves 2026: 15 Finance Tips for Pros

The first time I felt “successful,” I celebrated with a new laptop and an expensive dinner… and then my car battery died the same week. I remember staring at the tow receipt thinking, How can I be doing well and still be one surprise away from chaos? That tiny financial gut-punch sent me down a rabbit hole: cash flow audits, retirement contributions, and the surprisingly emotional process of paying myself first. This post is the set of money moves I wish someone had handed me earlier—15 tips, but organized the way my brain actually uses them on a Tuesday morning.

Assess Your Finances (Before You “Optimize”)

Before I try any “money optimization,” I do a simple 30-minute money inventory. No judgment—just facts. I list my assets (cash, retirement, investments), my debts (balances + rates), my monthly expenses, and my cash flow (what comes in vs. what goes out). This one habit keeps my 2026 financial plan grounded in reality.

My quick litmus tests

- Can I name my top 3 spending categories without looking?

- Do I know my highest APR (credit card, personal loan, etc.)?

Mini-audit checklist I run monthly

- Subscriptions: what I use, what I forgot, what quietly increased

- Due dates: bills, minimum payments, and autopay settings

- Interest rates: especially variable rates and promo expirations

- W-4 withholdings: do they still match my income, bonuses, or side work?

One tangent that matters: I track one “joy spend” on purpose. When I tried cutting everything, I rebound-spent later. A planned treat keeps me consistent.

My tip stack: I separate fixed paycheck income from irregular income (bonus, commission, freelance), then I budget from the minimum number.

Finally, I set a baseline plan: what I’d do if income drops 10%, and what I’d do if it rises 10%.

Make Budget Stick (Without Becoming a Monk)

My imperfect rule is simple: budget for reality, not for the version of me who meal-preps flawlessly and never forgets a bill. When I plan like a “perfect” person, I fail fast. When I plan like me, the budget actually sticks.

Start with 50/30/20, then adjust by season

I use the 50/30/20 budgeting split as a starting template (needs/wants/savings). Then I tweak it based on the month. A travel-heavy month needs more “wants,” while a quiet month is my chance to push extra into savings or debt.

My two-buffer system (to stop the oops spiral)

- Weekly buffer: a small cushion for random stuff (coffee, parking, last-minute gifts).

- Monthly buffer: a bigger cushion for the “how did that happen?” expenses.

Make categories honest

A practical tip that changed my behavior: I rename categories to match what I’m really doing. “Convenience Food” hits harder than “Dining Out”, and it makes me pause before ordering.

My 10-minute Friday money reset

Weird trick that worked for me: I schedule a 10-minute Friday “money reset” like a meeting. I scan transactions, move money into buffers, and catch problems early.

Finally, I watch the silent budget killers: subscriptions, delivery fees, and those “small” interest charges that add up fast.

Pay Yourself First (Automating Savings Contributions)

I treat savings like rent: it leaves first, or it magically won’t leave at all. In Money Moves 2026, this is one of my most reliable finance tips for pros because it removes willpower from the plan.

Automate it on payday

On payday, I set up automatic transfers so my money splits before I can spend it. My default split looks like this:

- Emergency fund: cash for real-life surprises

- Retirement savings: 401(k), IRA, or similar

- Sinking fund: boring-but-useful money for car repairs, gifts, travel, and annual bills

My simple two-account setup

I keep one account for bills and one for spending. My paycheck lands in bills first, then an automatic “allowance” moves to spending. That means less mental math and fewer surprises when autopay hits.

Start small on purpose

I’d rather automate $50 and keep the streak than promise myself $500 and quit. Once it feels normal, I increase it in small steps.

Use raises to level up

When I get a raise, I like the half-and-half move: 50% to lifestyle, 50% to goals (retirement contributions or debt).

Wild card: If my phone died today and I couldn’t log into banking, would my plan still work? Automation makes that “yes.”

Emergency Fund: The Boring Hero of 2026

I used to think an emergency fund was extra. Then I met the dentist bill. That one surprise expense reminded me that “I’ll handle it later” is not a plan, especially in 2026 when prices can jump fast.

My simple target (and how I started)

My goal is 3–6 months of essentials: housing, food, insurance, utilities, and minimum debt payments. I didn’t start with a huge number. I started with $1,000 because it was emotionally achievable, and it got me moving.

Keep it boring and liquid

For this job, I want safety, not excitement. A high-yield savings account beats risky investing because I need the money available today, not after a market rebound.

Rules I follow

- Emergency fund is for emergencies, not inconvenience.

- If I use it, I replenish it like a bill with an automatic transfer.

“Real emergencies” I’ve actually used it for

- Car repair that had to happen this week

- Last-minute flight for a family situation

- Unexpected medical copay

Bonus buffer for variable income

If your pay includes commissions or bonuses, I like adding a bonus buffer layer on top—one extra month of essentials—so a smaller bonus doesn’t wreck your cash flow.

Manage Debt Effectively: Credit Card Balances First

My honest confession: I once paid extra on a low-interest student loan while my credit card debt quietly burned at a higher APR. It felt responsible, but the math was working against me. In my 2026 debt payoff plan, I treat credit card balances like a fire to put out first.

Step 1: Put every debt on one list

I write down each balance, the APR, and the minimum payment. High-interest debt gets the spotlight because it grows the fastest.

| Debt | APR | Minimum |

|---|---|---|

| Card A | 24% | $60 |

| Card B | 18% | $45 |

| Student Loan | 5% | $120 |

Pick a payoff style that you’ll stick with

- Highest APR first (math win): pay extra on the most expensive card.

- Snowball Method (motivation win): pay extra on the smallest balance for quick wins.

Practical moves that helped me

- Automate minimums so I never miss a due date.

- Throw “found money” at the target card: bonuses, refunds, side income, even unused subscriptions.

- If I’m juggling multiple credit card balances, I set one rule: no new balance while I’m in payoff mode.

The underrated win: paying down debt frees up future cash flow—like giving yourself a tiny raise.

Set Retirement Goals + Grab the Employer Match

I used to treat retirement like a “future me” problem—until I saw how fast years move when you’re busy. Once I framed it as a simple monthly habit (not a giant life project), it got easier to act.

My first priority: the employer match

If your workplace offers a 401(k) match, I treat it like the closest thing to free money I’ve ever been offered. Many plans match somewhere around 3–6% of salary. If you’re contributing below that, consider this your nudge to at least hit the match line.

- Step 1: Find the match formula in your benefits portal.

- Step 2: Set your contribution to capture 100% of the match.

Then ladder up, slowly

After I hit the match, I “ladder up” my retirement contributions gradually. My favorite approach is +1% each quarter. It’s small enough that I barely feel it, but it adds up fast over a year.

Add tax flexibility (Roth vs. traditional)

If you can, I like diversifying tax treatment—some traditional (tax break now) and some Roth (tax-free later). That mix can give you more options when you start withdrawals.

Retirement savings is less about perfection and more about consistency.

Tax Strategy Retirement: Stop Donating an Interest-Free Loan

The most annoying money lesson I learned: a big tax refund can mean I overpaid all year. That’s not “free money”—it’s an interest-free loan I gave the government instead of using that cash for my goals.

My first move after any income change

Any time my pay changes (promotion, bonus shift, new side gig), I review my W-4 withholdings. I want my paycheck taxes to match my real situation, not last year’s. Small tweaks now can prevent a surprise bill—or a too-big refund—later.

A simple retirement tax strategy I actually follow

For retirement planning, I try to diversify my future tax options. I combine tax-deferred accounts (like a traditional 401(k)/IRA) with Roth-style options where available. That mix gives me flexibility in retirement: I can choose which “tax bucket” to pull from depending on my income and tax rates.

My year-end checklist

- Confirm I’m on track to max (or hit my target) for retirement contributions

- Organize charitable receipts and donation confirmations

- Check HSA/FSA deadlines and contribution limits (if applicable)

I also keep a running “tax notes” doc all year—bonuses, side income, big deductions—because future me always forgets what past me did.

If taxes make your eyes glaze over, I outsource strategically: I pay for one hour with a pro to set the plan, then I maintain it myself.

Check Credit Report + Protect Your Future Self

I schedule one boring calendar event each year: check my credit report and skim for weirdness. It takes less time than a coffee run, and it protects “future me” from expensive surprises.

Credit health isn’t just a score; it’s the cost of borrowing (rates on mortgages, auto loans, even some business credit) and sometimes it affects housing options when landlords run checks. That’s why I treat it like basic career maintenance.

My simple annual routine

- Review accounts: I confirm every loan, card, and limit looks right.

- Dispute odd items: wrong balances, accounts I don’t recognize, or late payments that aren’t mine.

- Set up alerts: I turn on notifications for new inquiries and account changes.

If I’m paying down credit card debt, watching my utilization drop is oddly satisfying—and it can help my score over time. I also check that my cards report correctly, because one high balance at the wrong time can make my profile look riskier than it is.

A small privacy move: I freeze my credit when I’m not applying for anything soon. It’s a simple way to block most new-account fraud.

Tangent: I keep a “money admin” folder—password manager notes, key statements, and beneficiary info—because chaos is expensive.

A 2026 Mindset: Portfolio Resilience, Not Prediction

I’m done trying to predict the market. In 2026, my job is to build portfolio resilience I can live with—so my plan still works if stocks drop, rates change, or headlines get loud.

Flexibility beats perfect forecasts

If rate cuts are expected, I may lean toward shorter-maturity fixed income for flexibility. It’s not a guarantee—just a lens that helps me avoid getting locked in if conditions shift.

Rebalancing with calm, not hype

I rebalance when something feels “too hot” or “too scary.” Emotion is data, but it’s not the boss. If one asset grows far beyond my target, I trim. If something solid gets crushed, I add—based on my rules, not my mood.

Protect near-term goals

A simple rule: don’t invest money you’ll need soon. That’s what my emergency fund and short-term savings are for. Investing is for long-term goals, where time can absorb volatility.

Harnessing AI (carefully)

I’ll use AI tools to summarize spending patterns or simulate “what-if” scenarios, like job loss or a 20% market dip. But I won’t outsource judgment. I still decide what risks I can handle.

Your financial plan is like packing for a trip—layers beat one perfect outfit.

- Layers = cash buffer, diversified investments, and flexible income choices.

- One outfit = betting everything on a single prediction.

Conclusion: My 15 Tips, One Simple Loop

If I had to compress everything in these 15 finance tips for pros, it’s this simple loop: assess → automate → protect → pay down → invest → review. I’ve learned the loop is what makes the tips work; the tips alone are just trivia. When I run the loop, I catch problems early, I make fewer rushed choices, and my money starts to feel calmer.

I revisit my financial goals quarterly, because that’s often enough to stay on track without overthinking. But I keep the weekly habits tiny: a 10-minute reset to check balances, scan upcoming bills, and confirm my automation is still doing its job. Small check-ins beat big “money weekends” that never happen.

Here’s the reminder I wish I’d heard earlier: being good with money isn’t a personality trait—it’s a practice. You don’t need to be “naturally disciplined.” You just need a repeatable system that keeps you moving, even when work gets busy.

My next-step challenge is simple: pick one move for the next 7 days—automate $50 toward savings, check one bill for errors, or list your debts and interest rates. Do one thing, then run the loop again.

Closing aside: you don’t need to love finance—you just need fewer financial surprises in 2026.

TL;DR: Audit your cash flow, pay yourself first (automate it), build an emergency fund, kill high-interest credit card debt with a clear method, capture the employer match, use the 50/30/20 rule, check your credit report, and build a flexible tax strategy for retirement—then repeat quarterly.

Comments

Post a Comment